Weaknesses

- Saturation of some hardware markets (tablets, smartphones, PCs) in advanced economies

- Long-term challenges regarding rare mineral reserves

- Tougher regulatory environment ahead for ICT giants, notably in terms of taxes and data protection

Risk assessment

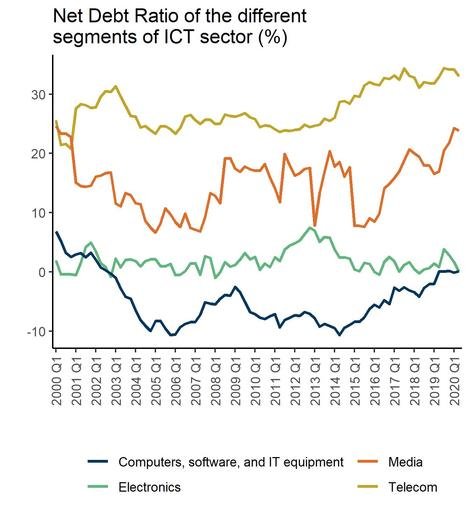

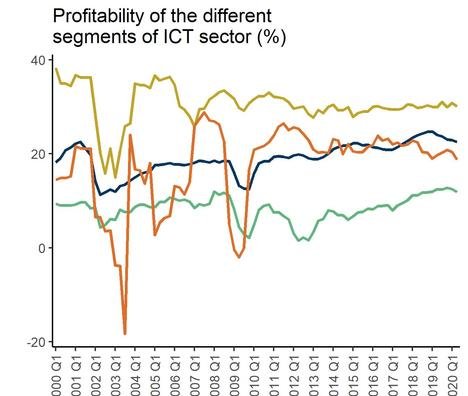

Coface’s sector assessment methodology for the Information and Communication Technologies (ICT) sector incorporates several segments: telecommunications, electronics, medias and a final segment comprising of computers, software, and IT equipment. Empirically, the boundaries are increasingly blurred between the product and service ranges offered by ICT companies and the firms’ traditional business activities.

The Covid-19 crisis has affected the different segments included in ICT to various degrees, even though it remains overall among the most resilient sectors in the context of this crisis, in comparison to the other sectors for which Coface produces sector assessments. However, despite the contraction of global GDP (-4.8% in 2020 according to Coface), all segments should remain resilient. The media segment has benefited from the mobility crisis induced by the health crisis, generating strong demand and an increase in production. As for the telecommunications and electronics segments, they should gradually recover, albeit with disparities between regions. The recovery is expected to be weaker in Europe than in the United States and Asia. Finally, the computer hardware segment should also gradually recover thanks to significant demand due to the rise in teleworking and increased network performance.

Despite this recovery, the challenges that the sector faced before the Covid-19 crisis remain. On the one hand, the trade war is intensifying and is continuing to focus on technological issues. On the other hand, regulatory evolution

being more restrictive in terms of data protection and taxation - notably towards the “Tech giants”, are still underway.

Source : Datastream Refinitiv, Coface

Sector Economic insights

The Media segment should remain 'resilient' to the COVID-19 crisis.

The mobility crisis generated by the pandemic continues to benefit the media segments, unlike the other segments of the ICT sector. Indeed, the majority of segments have been affected by the double shock of supply and demand induced by containment measures, which were imposed by almost half of the countries worldwide in the second half of 2020. Supply was impacted by plant closures that led to abrupt production stoppages and supply chain disruptions. Demand has been disrupted by the drop in production, as well as by the economic crisis, which caused a drop in consumption of both households and businesses.

Indeed, individuals are being forced to stay at home more. Interest in new media has increased, especially the supply of entertainment, resulting in an increase in demand. According to Capital Economics, a survey was carried out in the United Kingdom and the United States in the third quarter of 2020, with 40% of surveyed planning to subscribe to a new media to which they were not subscribed before the crisis. Because

of this strong demand, supply has been vigorously stimulated and production has increased. Coface expects demand to remain dynamic, given an environment in which authorities in different countries around the world continue to promote teleworking, whenever possible, as well as social distancing. This context, including teleworking, is likely to accelerate changes in lifestyle and work habits, which should maintain the demand for these types of products in the long-term.

A gradual recovery in the Telecommunications, electronics and computer hardware segments is expected by 2021.

The abovementioned ICT segments should remain resilient, despite significant regional disparities. The sector is expected to recover gradually, with a recovery in supply due to the reopening of production plants, as well as an upturn in demand generated by the gradual economic recovery that started in the second quarter 2020. The recovery in the electronics and telecommunications segments is expected to be weaker in Europe than in Asia and the United States, the latter being the two leaders in the ICT market. The pandemic is leading to high unemployment, which should increase in the long-term in Europe. According to Capital Economics, the unemployment rate is expected to rise to 12% in Europe and to 5% in China and the United States by the end of 2022. This would lead to a drop in income for European households, thus entailing a decrease in consumption. Subsequently, demand should then pick up slightly in Europe. Furthermore, the propensity to spend on electronic equipment and telecommunications is higher in some East Asian countries compared to the United States or Europe. Finally, the development of telecommunications is of paramount importance to the Chinese government, particularly in the context of its “Made in China” 2025 plan, under which the authorities aim to make China a leader in new technologies by 2025. Therefore, public investment in this segment should not suffer from the health situation or the economic environment.

In contrast, due to the abovementioned reasons, the electronics and telecommunications segments will probably experience a more difficult recovery in Europe and the United States, as household consumption should be less dynamic than in Asia. In India, the recovery is more uncertain, as there has not been a significant drop in the virus data that could have marked the end of a ‘first wave’. In this context, the government has had to continuously extend containment measures. Furthermore, the economic situation is worse than in other major economies in the region, with GDP expected to contract by 8% this year, according to Coface's estimates. According to Fitch, electronics spending is expected to fall by 9.9% year-on-year in the country in 2020. Therefore, the sector is unlikely to return to pre-crisis levels by 2021. The purchase of computer equipment was boosted before the first wave of containment measures in the first half of 2020. Indeed, the implementation of teleworking in particular generated a strong demand for IT equipment and services. This demand

should remain sustained in the medium- and long-term, given the context. The technology giants, the FAANGs (Facebook, Amazon, Apple, Netlfix and Google), have seen their results rise sharply because of containment measures. They are investing to improve their performance. For instance, Google, which had already invested in wind farms, is continuing to invest large sums of money in underwater cables in order to respond to the increase in internet traffic, as well as internal needs. The Internet networks of these leaders are becoming increasingly efficient, which could encourage companies and households to consume more, despite the financial difficulties linked to the economic crisis.

The pre COVID 19-crisis challenges remain: the China-u.s. trade war and regulatory developments

The trade war continues to focus on technological issues. The Covid-19 pandemic demonstrated the need for greater network performance, which could be partly provided by 5G. Massive investments in 5G could then be considered. However, tensions between China and the United States persist and could hinder electronic commerce and alter the deployment of 5G. The restrictions imposed by the Trump administration, notably on one of China's ICT leaders, Huawei, principally on the information structure, have once again been tightened to limit its access to semiconductors. From now on, Huawei is no longer allowed to use American technology to produce components. Any use of American software or manufacturing equipment to produce objects via Huawei requires a license. Furthermore, President Trump took important measures against the Chinese applications 'TikTok' and 'We Chat'. The U.S. President accuses these applications data misappropriation from U.S. users to the Chinese government. In practice, an injunction from the U.S. government requires that part of TikTok's capital be American, so that it can operate on U.S. soil. As for We Chat, the Trump administration threatened to ban the application on U.S. territory, but a judge suspended this ban. Retaliation by the Chinese government is also on the technological front. Indeed, in August, China made inaccessible nearly 47,000 applications in the App store of U.S. technology giant Apple. In recent months, the trade war has been turning into a technological war. Moreover, the regulatory environment for ICT companies should become increasingly restrictive in the coming years, particularly regarding the protection of consumer data, following several scandals involving American companies (notably the misuse of user data by Facebook, which forced it to pay a record USD 5 billion fine in 2019 imposed by the U.S. federal agency for the control of commercial practices, the FTC). Because of the Covid-19 crisis, the IT capabilities of technology companies have been called upon in a number of countries, in particular for the tracking of Covid-19 cases, in order to trace the transmission chains. These tools should be used in case of emergency and only for the common good. Once the emergency is over, the data should no longer be available. However, in order to do so, governments (particularly in advanced economies) could strengthen or implement a legal framework on the protection of

private data to ensure transparency and privacy. This could result in even more stringent regulations. The ongoing increase in data protection standards in important markets, such as Europe or North America, could affect the business models of the ICT giants and contribute to market fragmentation. Indeed, data protection rules could differ significantly from one state to another in the United States, for example, as well as from one region of the world to another, while large ICT companies operate globally.

E-Library & File Box

E-Library & File Box