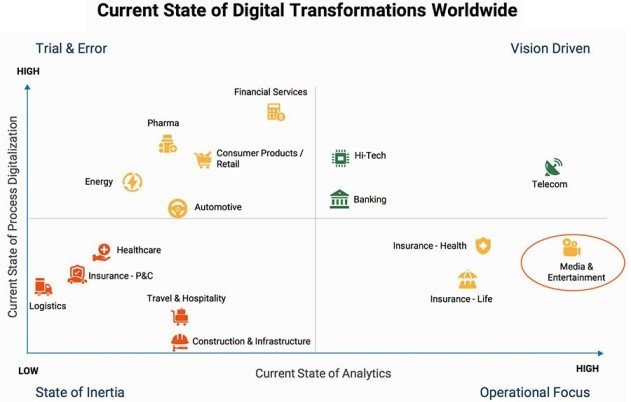

Trianz defines digital transformation as the “reimagination of a company’s portfolio of products and services to create exceptional customer and stakeholder experience chains.” The firm measures the level of digital transformation as a function of analytics capabilities – which set the priorities and business model – and process digitalization, which denotes progress towards digital business processes and experiences.

The industries furthest ahead in digital transformation are telecom, high-tech, and banking. Trianz places them in the “vision-driven” quadrant, where companies have made balanced investments in analytics and digitalization.

The industries which are seriously lagging in analytics and digitalization investments are travel & hospitality, logistics, construction & infrastructure, P&C insurance, and healthcare.

Meanwhile, “trial & error” industries are reacting to pressure or digitalizing without adequate analysis, with hit-or-miss results (automotive, pharma, financial services, consumer products/retail). “Operationally focused” industries are investing heavily in analytics to better understand customers or squeeze operational profits (media, health and life insurance).

Overall, digitalization is still in the early stages in most companies, with so-called “digital champions” being three to four times more advanced than the global average. Digital champions have modernized several components, including harmonized business processes, applications, and IT infrastructure with unified engineering models. Most other companies have failed to properly prioritize their investments – even struggling to settle on a concrete definition of what transformation should mean.

The small elite of digital champions have set themselves apart in a number of areas, including analytics maturity, cloud, management alignment, cybersecurity, and customer-centricity.

Leaders have strong foundations in analytics capabilities, data governance, and KPI frameworks to understand and grow their businesses. Meanwhile, more than 70% of companies lack an understanding of digital key performance indicators, which enables firms to set quantifiable goals and measure success.

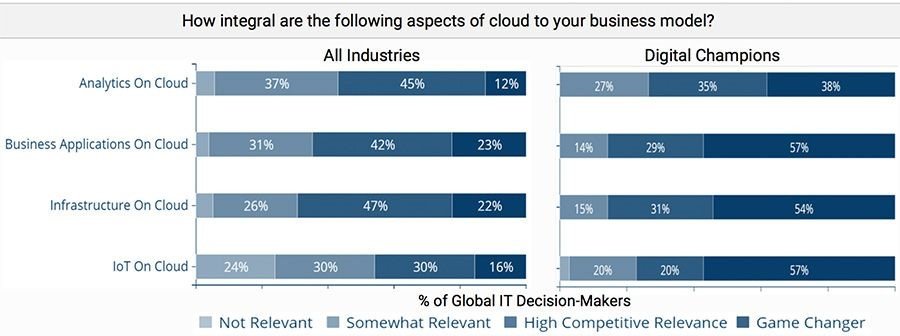

Cloud maturity is another area of strength for digital leaders. The high-tech industry reigns supreme here, with a massive lead on other industries. High-tech’s mature cloud infrastructure allows it to drastically accelerate its solution delivery cycle – saving 30-50% of cycle time. This gives them extra time to spend with clients to gain validation, acceptance, and deliver disruptive ideas, according to the Trianz report.

Digital leaders also strategically plan process digitalization across the entire value chain – including finance, back end, employee and customer experience, and brand. As such, business leaders across functions align on a common strategy and execution that reaches into all parts of the company.

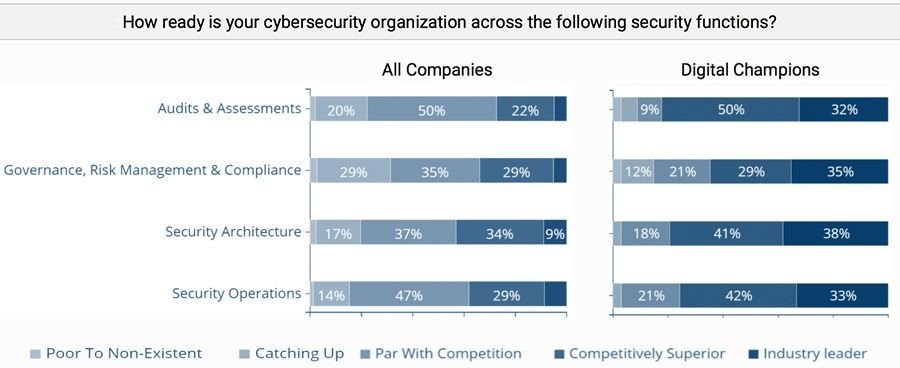

Besides having strong management alignment, digital champions have the most advanced cybersecurity. This requires a strong preparedness to respond to risk, with readiness in the functions of assessments, governance and compliance, security architecture, and security operations.

Finally, digital champions are focused on customer priorities as a top driver of transformation. According to Trianz, they follow customer needs and expectations when developing their transformation, with customer priorities (67%) even outstripping new disruptive technologies (64%) and new market opportunities (43%) as a primary driver.

Though today’s transformations are based on customer-driven reactions, advanced analytics will shape future strategy. According to the report, insights from analytics will set the transformation agenda for most industries by 2022. Trianz points to investment growth in data-foundations, data-lakes, and visualization, while the scope of growth is extending outwards from finance, sales, and marketing to areas such as research & development and human capital.

Looking ahead to 2022, projected spending on analytics and digitalization point to financial services, travel & hospitality, and media & entertainment joining the current leading industries of telecom, banking, and hi-tech.

E-Library & File Box

E-Library & File Box